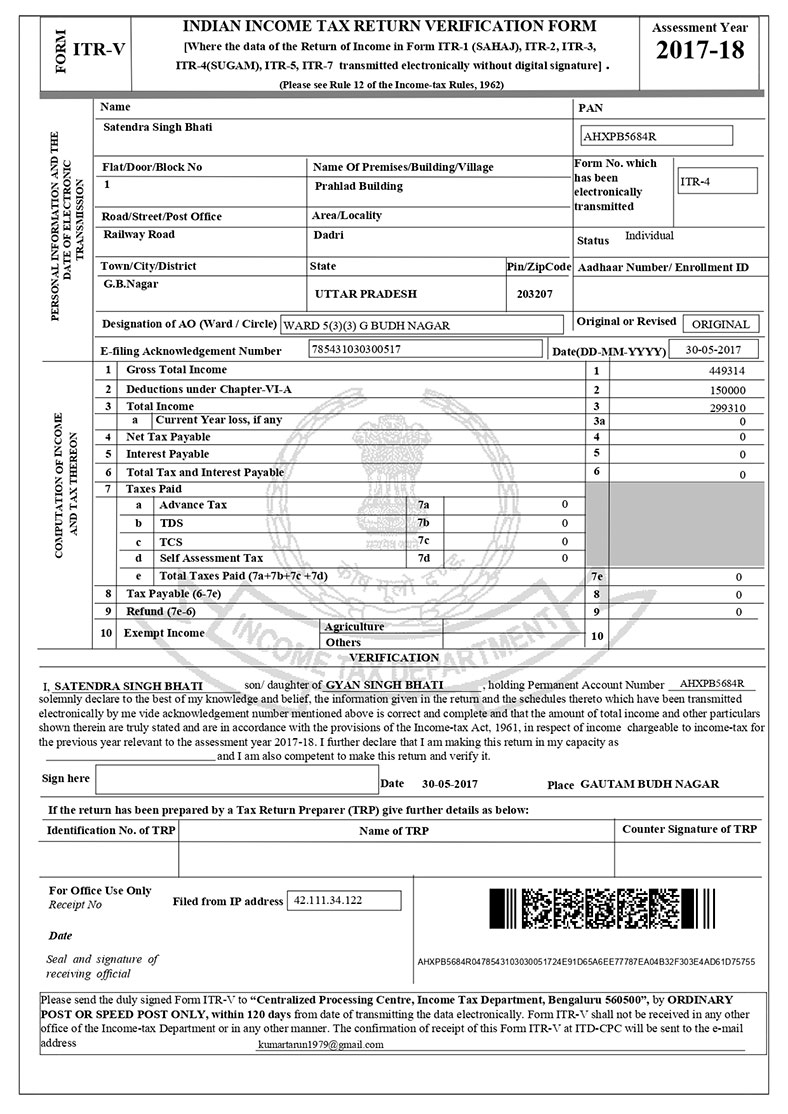

The Income Tax Return (ITR) is a document that must be submitted to the Income Tax Department of India. It comprises information on a person's earnings and the taxes that must be paid on those earnings throughout the year. The information in an ITR must be for a certain financial year, which begins on April 1st and ends on March 31st of the following year. The income could be in the form of a salary, business profits, rental income, dividends, capital gains, interest, or other forms of income. ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7 are the seven types of ITR forms required by the IT Department, and their applicability is determined by the nature and quantity of income as well as the type of taxpayer.

We are dedicated to not just taking care of our clients' taxation needs, but also to teaching the general public about taxes in order to eliminate the fear of taxes and make taxation a positive experience for everyone. We double-check everything to guarantee that you file accurate returns and receive the most refunds possible.

It's a pre-printed form that a person can use to provide the Income Tax Department with information about his or her earnings from various sources of income and taxes paid for the previous fiscal year.

Yes, if your income exceeds Rs. 2, 50,000 in a Financial Year (the basic exemption limit) without taking into account any deductions or investments, you must file an income tax return.

In some circumstances, electronic filing is required. If your total income exceeds Rs. 5, 00,000 per year or if you want to claim a refund, for example, you must e-file your Income Tax Return.

E-filing your tax return is faster, safer, and easier than filing it on paper. Because the returns are filed electronically, the computers process them automatically, resulting in faster reimbursements.

TDS stands for Tax Deducted at Source in its full form. Under the Income Tax Act, some payments, such as salaries and interest, are subject to tax deduction by the person making the payment.