According to the Companies Act, 2013 ("Act"), each company must employ an auditor to manage its books of accounts. The company's audit reports, which are generated by an auditor, are important papers. As a result, at its first Annual General Meeting, the firm must appoint an auditor. The Auditor's Resignation Act, Section 140(2), allows an auditor to quit. It stipulates that an auditor must file a declaration of resignation with the Registrar within thirty days after his resignation date, as specified in the Rules. The auditor of a government corporation or a company owned by the government will file the statement with the Comptroller and Auditor-General of India.

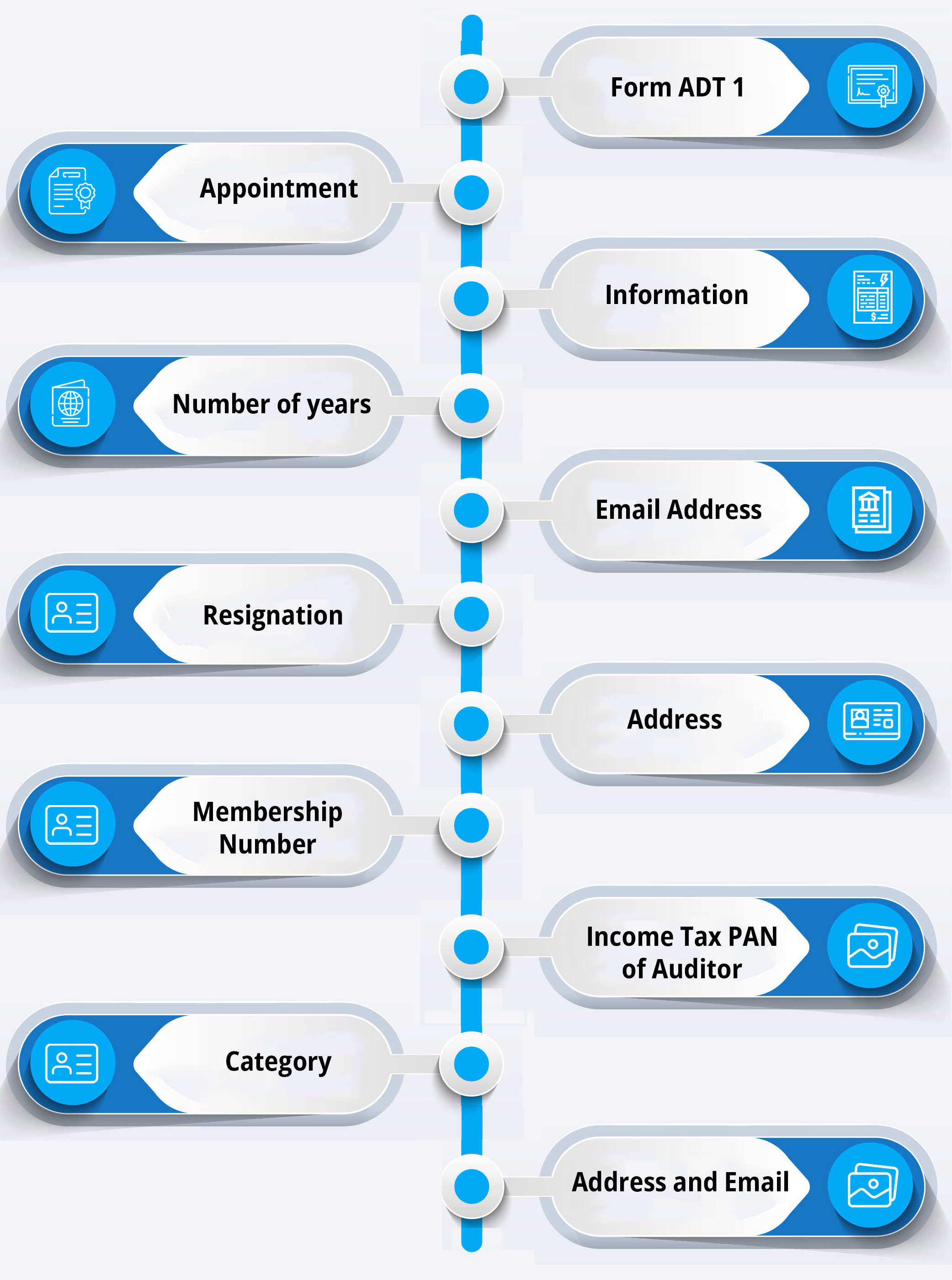

Below is the procedure for appointment-

According to section 139 of the Companies Act, 2013, the First Auditor of a business other than a government entity must be appointed by the Board within 30 days of its incorporation. If the Board fails to select the First Auditor within 90 days, an EGM (Extraordinary General Meeting) must be held. The 90-day period begins on the day of incorporation, not when the 30-day period ends.

Legal Birbal is dedicated to assisting entrepreneurs and small company owners in starting, managing, and growing their businesses with ease and at a low cost. Our goal is to educate the entrepreneur on legal and regulatory requirements and to be a partner throughout the whole business operations.

An auditor is a person who has been given the authority to check and verify the accuracy of financial records. The auditor makes sure that the businesses are following the tax regulations.

According to Section 140(1) of the Companies Act, 2013, an auditor appointed by a company can only be dismissed from his or her position before the term expires if a special resolution is passed.

Yes. At the moment of resignation, every auditor shall file an ADT-3.

A punishment of not less than Rs 25,000 but not more than Rs 5, 00,000 will be levied against the company.