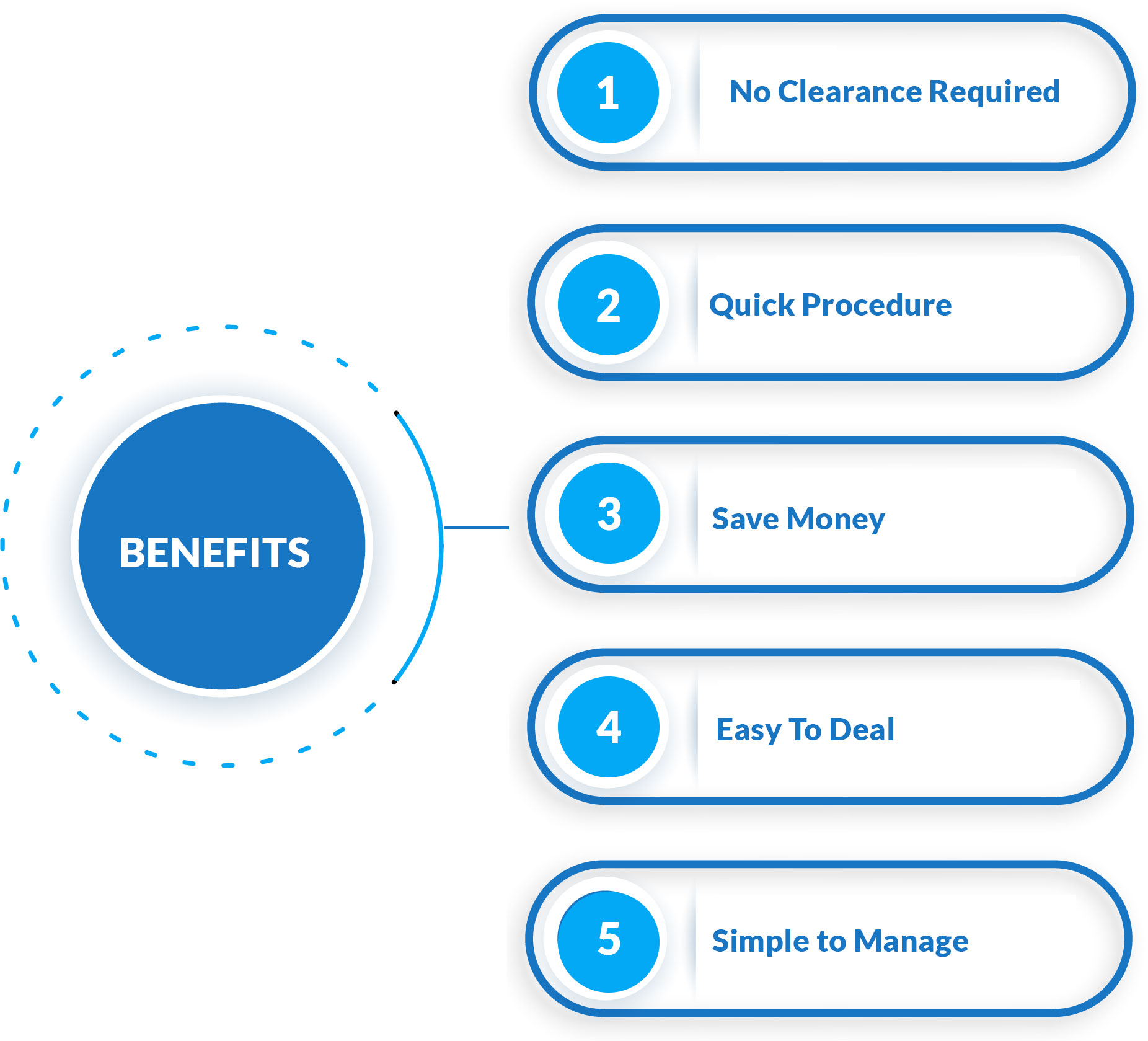

The Companies Act 2013 governs Nidhi Companies, which are a type of public limited companies. It gives you the most effective and simple approach to save money while also allowing you to expand your monetary growth. The main business of such a company is to facilitate money lending among the company's core members. It instils the habit of saving in its members and operates on the mutual benefit premise. Nidhi Company does not require a licence from the Reserve Bank of India (RBI), making it simple to establish, however RBI monitors all its financial dealings. It is a public company that should have "Nidhi Limited" as the last words in its name.

Nidhi Company is strictly prohibited to conduct business in the areas of chit funds, hire-purchase finance, leasing finance, insurance, or securities. Accepting deposits from or lending money to anyone other than members is absolutely banned. Furthermore, it is unable to market itself in order to solicit deposits.

The following requirements must be satisfied in order to register as Nidhi Company: Minimum of 5 lakh rupees is required for share capital Net Owned Funds (NOF) must be increased to Rs 1 lakhs within a year of registration Minimum of seven members are required At least three members must be the directors of the company Minimum of 200 members within one year of commencementMinimum Requirements

Below is the process of registering your business as Nidhi Company-

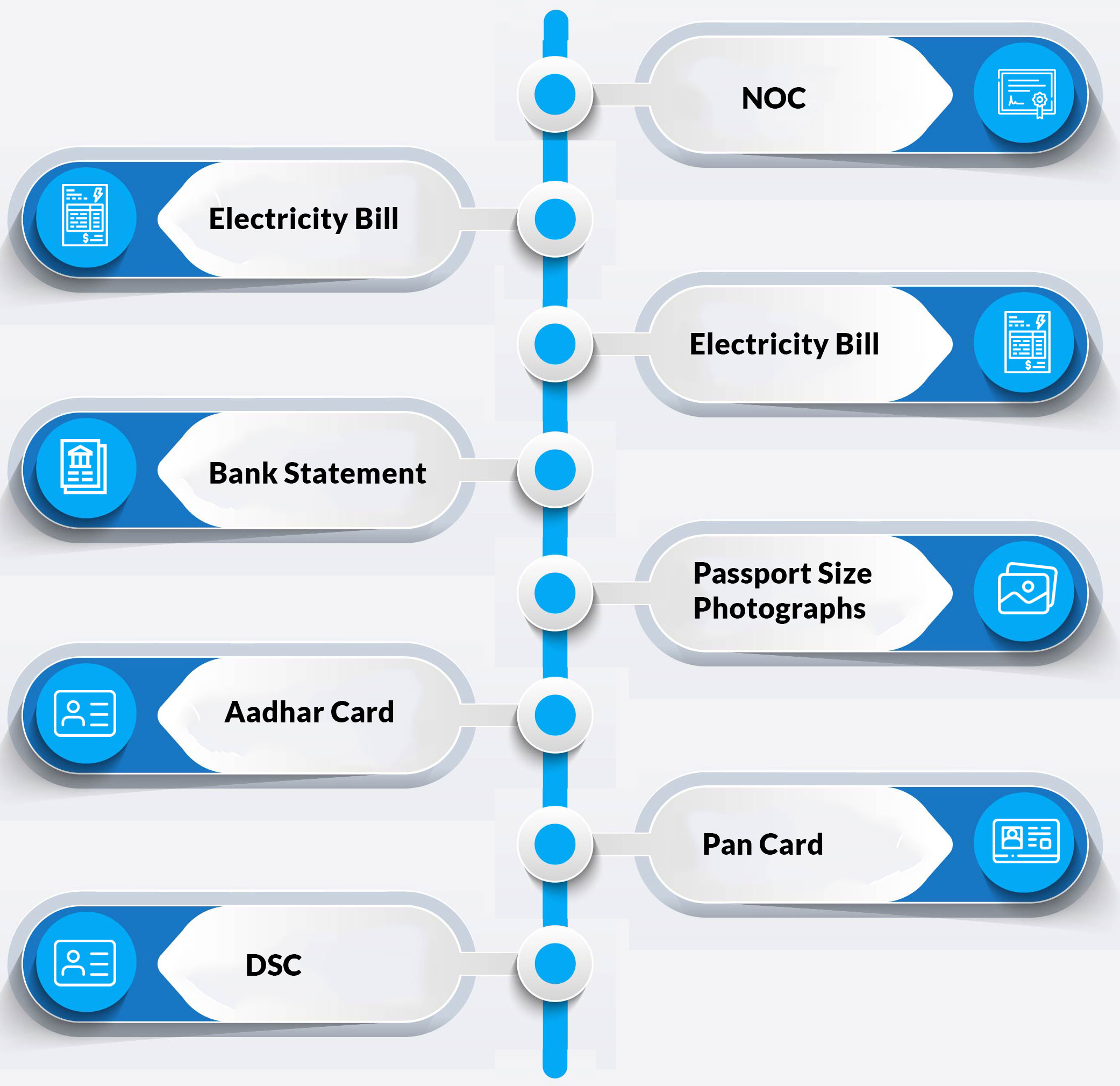

A Digital Signature Certificate is required because the incorporation of Nidhi Company is an entirely digital operation. A DSC must be obtained from one of the certified agencies by directors and subscribers to the company's memorandum of incorporation. Obtaining a DSC is a simple online process that might take as little as 24 hours to complete. The three basic verifications in this process are document verification, video verification, and phone verification.

To apply for a name for Nidhi Company, use the SPICe RUN form, which is part of the SPICe+ form. While filling out the name application, the company's industrial activity code and object clause must both be defined.

The company's registration details must be submitted in the SPICe+ form after the name has been authorised. It is a basic proforma for forming a corporation electronically. The details of the form are listed below:

The SPICe e-MoA and e-AoA are two forms that must be completed at the same time when a company is formed.

A Memorandum of Association is defined in Section 2(56) of the Companies Act 2013. (MOA). It is the foundation upon which the company is built. It establishes the company's legal structure, authorities, and goals.

The Articles of Association are defined in Section 2(5) of the Companies Act (AOA). It puts forth in great detail all of the company's management rules and regulations.

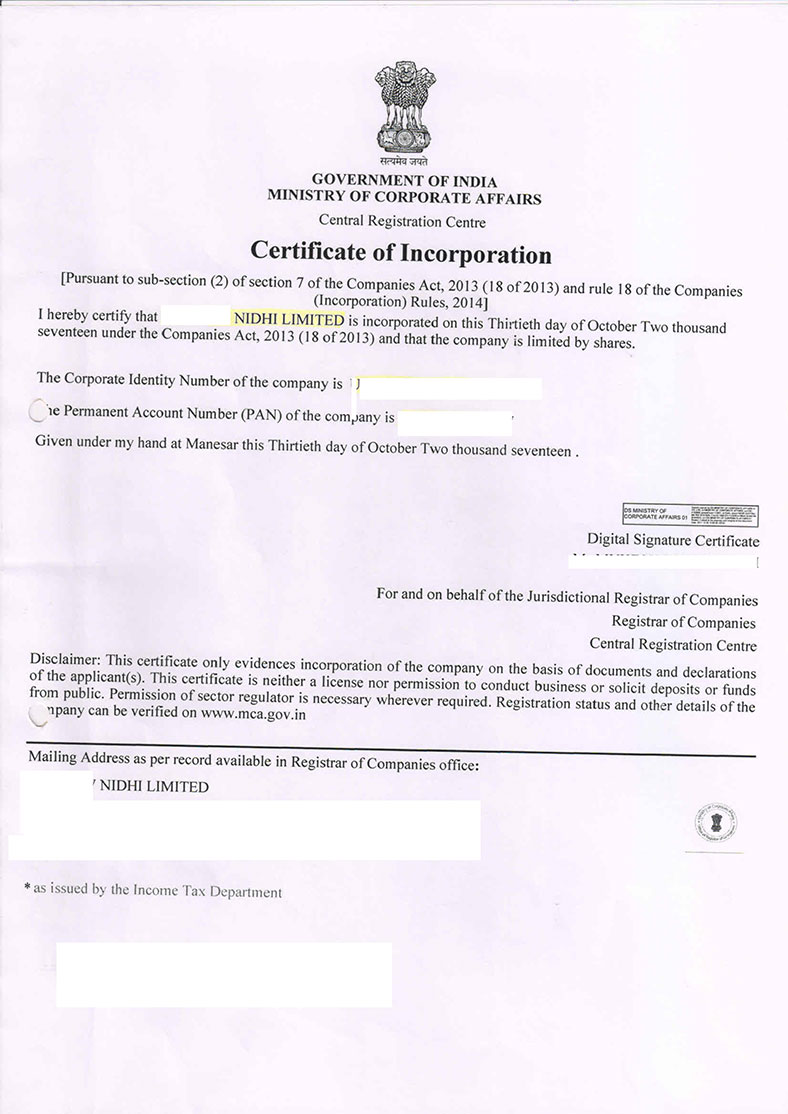

PAN, TAN, and Certificate of Incorporation shall be issued by the competent department after the Ministry of Corporate Affairs approves the above-mentioned documents. Using these documents, the organisation is now required to open a current bank account.

We enable a smooth interaction with the government by managing all of the documentation. To create reasonable expectations, we provide clarity on the incorporation procedure. We are a well-organized staff of professional CAs, CSs, and lawyers, backed up by a pool of well-known accountants and other members across India, to give exceptional services.

The main motive of such a company is to facilitate lending money between the core members of the company.

You need to provide theimportant documents and fulfilling the requirements of a nidhi company as per the Companies Act, 2013.

A minimum of 3 directors and 7 shareholders are required for its registration

Yes, Nidhi Company in India can open a current account.