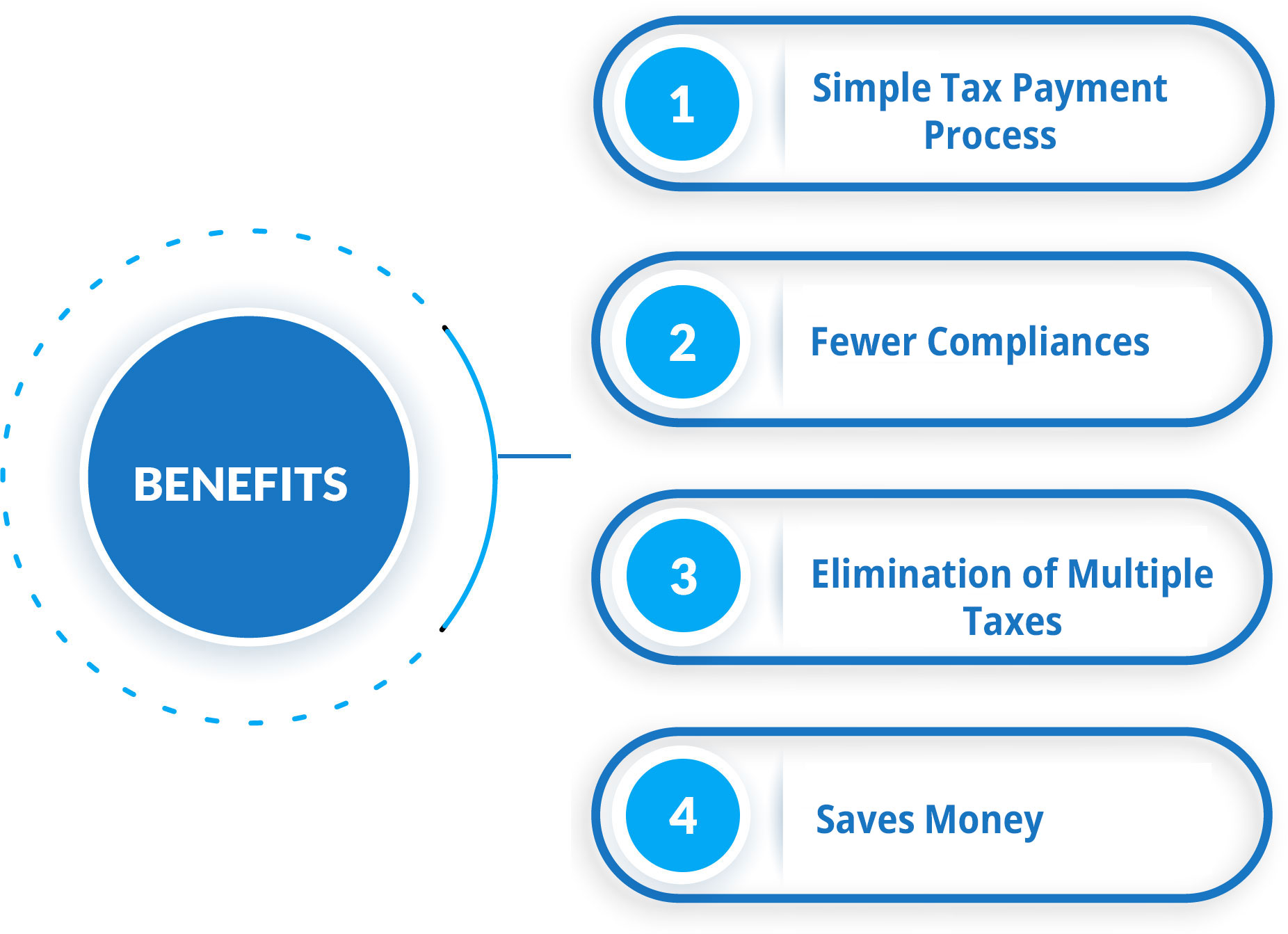

GST is the result of India's largest tax reform, which has greatly enhanced the ease of conducting business while simultaneously expanding the Indian taxpayer base by bringing millions of small enterprises under one unified tax structure. India's tax complications have been greatly reduced as a result of the implementation of GST. Multiple tax systems are being phased out and replaced by a single, straightforward tax system known as GST. By registering for GST, you will be able to collect GST from your customers. As a result, you must file for GST in order to prevent any legal entanglements.

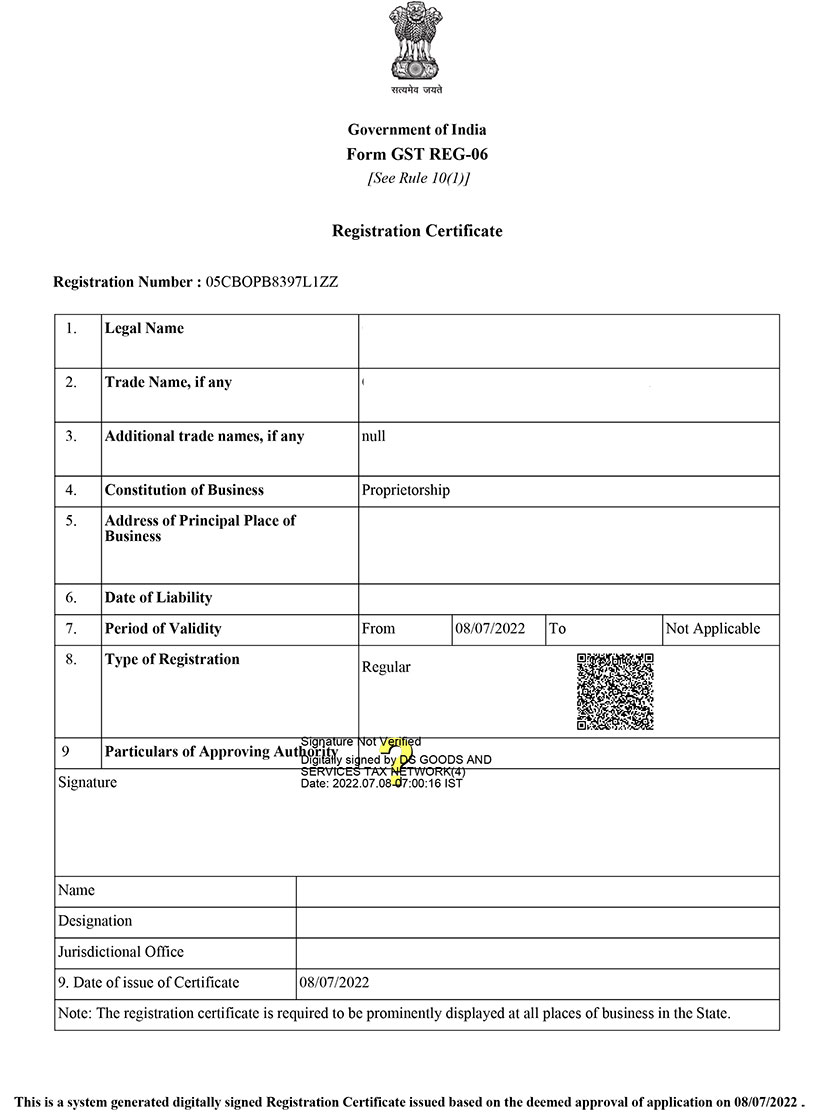

The Goods and Services Tax (GST), which went into effect on July 1, 2017, applies to all Indian service providers (including freelancers), traders, and manufacturers. A number of central taxes, such as Service Tax, Excise Duty, and CST, as well as state taxes, such as Entertainment Tax, Luxury Tax, Octroi, and VAT, have been merged into one tax, GST, which went into effect on July 1, 2017. Businesses with a turnover of more than Rs. 40 lakh are obliged to register for GST. Businesses in hill states and North-Eastern states have a turnover of ten lakhs rupees.

The following businesses are required to get GST Registration:

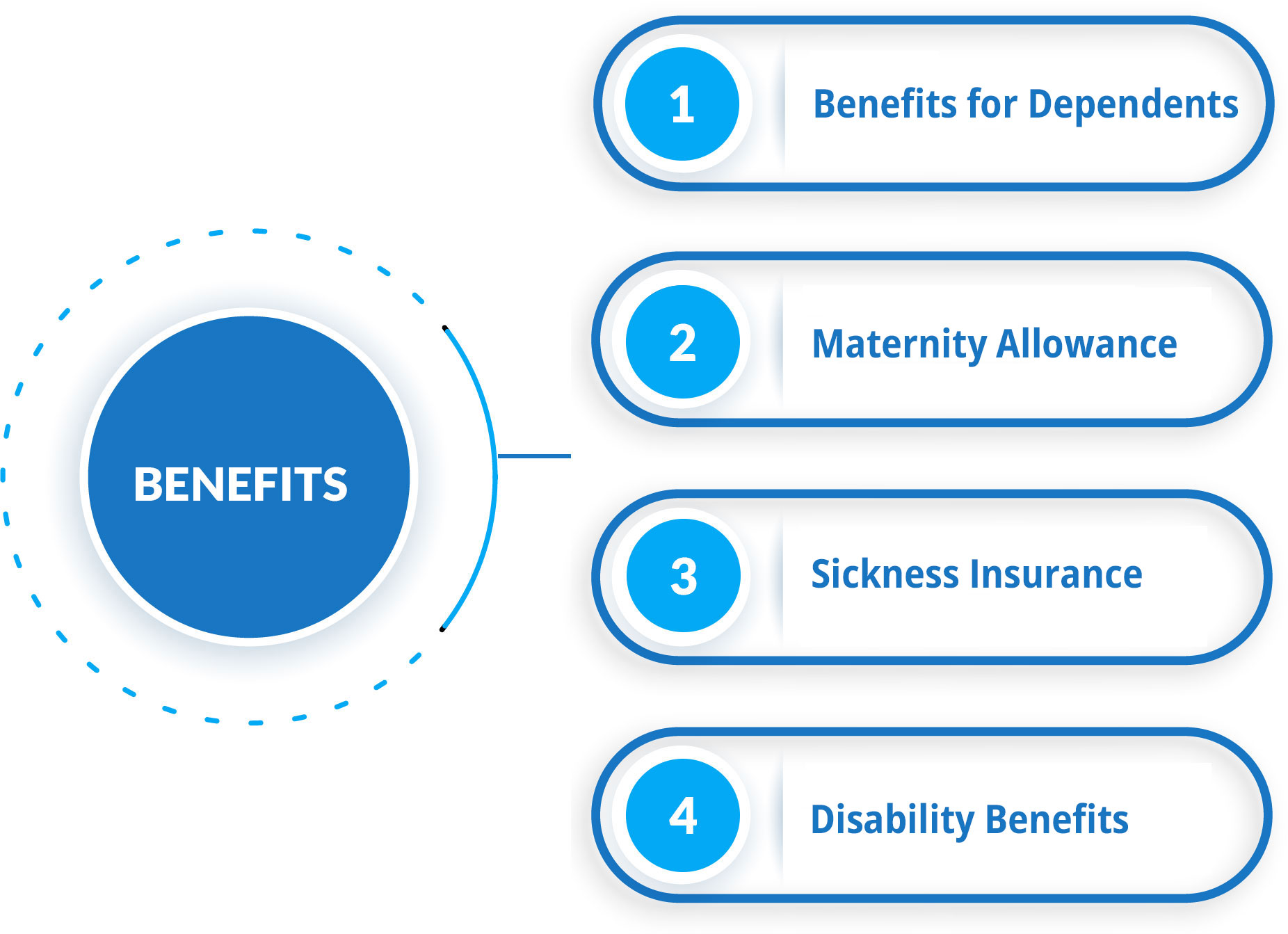

An entity can voluntarily register for GST; before, an entity with a voluntary GST registration could not resign its registration for up to a year. The applicant can now surrender their voluntary GST registration at any moment after the recent amendments.An individual who supplies goods or services seasonally or intermittently through a temporary stand or shop is needed to register for GST

Individuals who sell products or services through an E-commerce platform in India should register for GST.

If a business is involved in supplying goods from one state to another in India, it needs register for GST.

A service provider that is providing services valuing more than Rs.20 Lakhs aggregate in a year is needed to get GST Registration.

With us, you can get the GST registration easily and seamlessly. Our experienced and knowledgeable

executives are available to explain the whole process and clear any queries you may have.

GST is a single indirect tax for the entire country, resulting in India becoming a centralised common market.

An entity that is required to register under GST must do so within 30 days of meeting the requirements. Before starting a business, casual taxable individuals and non-resident taxable persons must register with the GST.

Each type of business requires documentation that are specific to that type of business. ID proof, address proof, business registration proof, bank details, passport-sized pictures, and other essential paperwork are required in each situation.

A products provider with a yearly turnover of Rs. 40 lakh (Rs. 20 lakh in special category states) must register for GST. Even if the taxable person's turnover does not exceed the threshold, he may be required to pay GST in certain circumstances.