Returns for a Limited Liability Partnership (LLP) should be filed on a regular basis to ensure compliance and avoid the harsh penalties imposed by the law for non-compliance. When compared to the compliance obligations placed on private limited firms, a Limited Liability Partnership has only a few compliances to follow each year. Fines, on the other hand, appear to be extremely high. Noncompliance can cost a private limited company up to INR 1 lakh in penalties, whereas it can cost an LLP up to INR 5 lakh. The financial year for limited liability partnerships (LLPs) runs from April 1 to March 31. The partners should be in charge of keeping accurate records, preparing an income tax return, and submitting an annual return.

Below is the procedure for LLP annual filing-

A group of academics is known as Legal Birbal. The complete staff here is made up of highly qualified CAs, CSs, lawyers, and business managers. It's a one-stop shop for LLP annual compliance and electronic filing. We also offer services such as startup consulting, secretarial compliance, PAN / TAN application, DIN allotment, GST registration, Trademark registration, GST / Income tax return filing, and more.

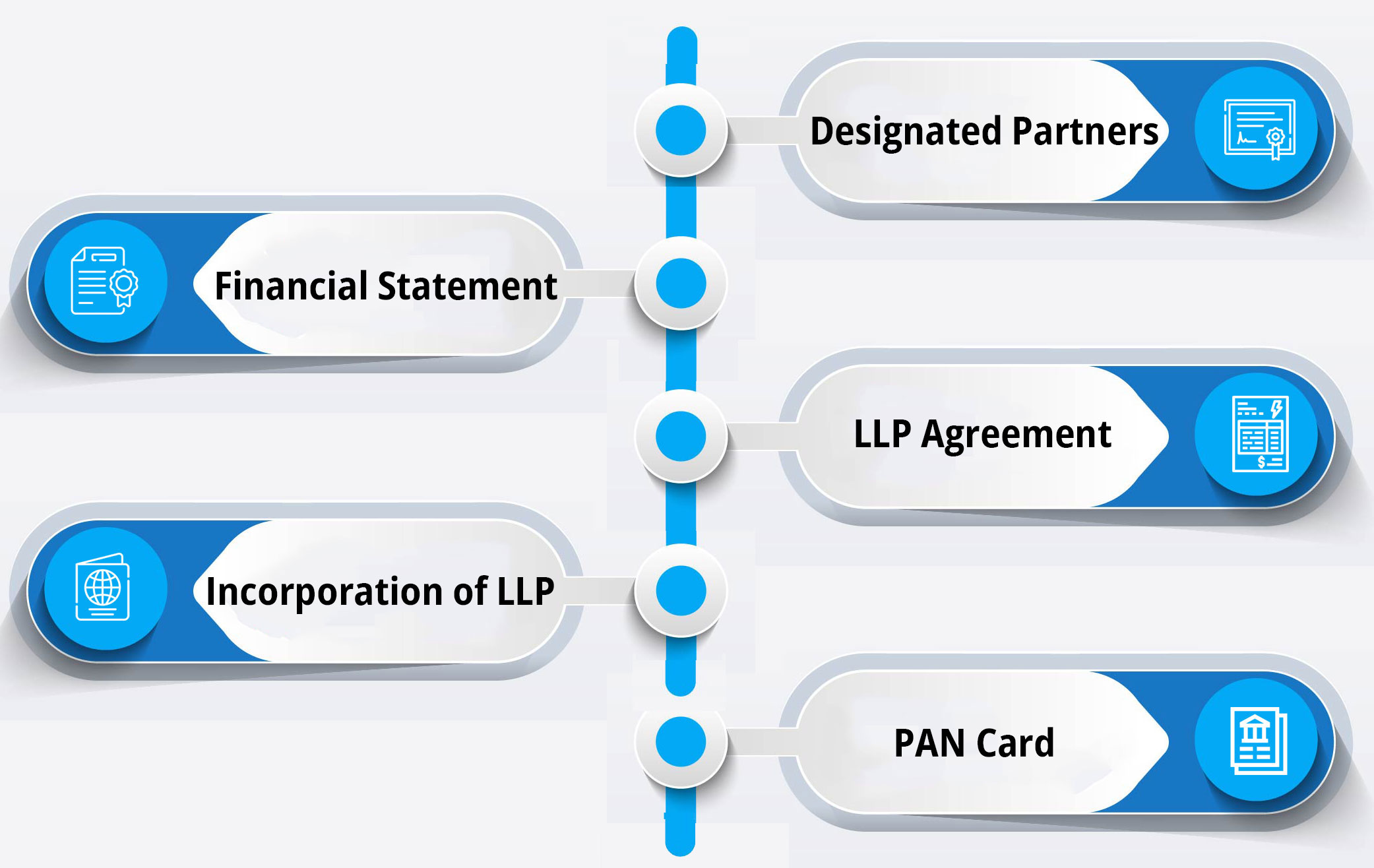

The LLP annual return, the financial statement of accounts and solvency, and the income tax return are all required to be filed by an LLP.

Every year, all LLPs registered in India must file the LLP Form 8, often known as the statement of account and solvency. Regardless of the amount of turnover, it must be filed with the MCA.

Only those LLPs with an annual sale of more than Rs. 40 lakhs or a contribution of more than Rs. 25 lakhs are required to have their accounts audited under the LLP Act.

By the 30th of October, Form 8 must be completely filled out. A penalty of Rs.100 per day of delay may be imposed if you fail to file.