The simplest form of business entity in India is a sole proprietorship, which is owned and managed by a single individual. It is the most straightforward method of registering and launching a business. Registration is not necessary for a Sole Proprietorship business because it is recognised through other registrations, such as GST registrations. Its responsibility, on the other hand, is boundless, and it does not exist indefinitely. It is the simplest form of business in India because it is not governed by any laws. One person is responsible for all the decisions and management.

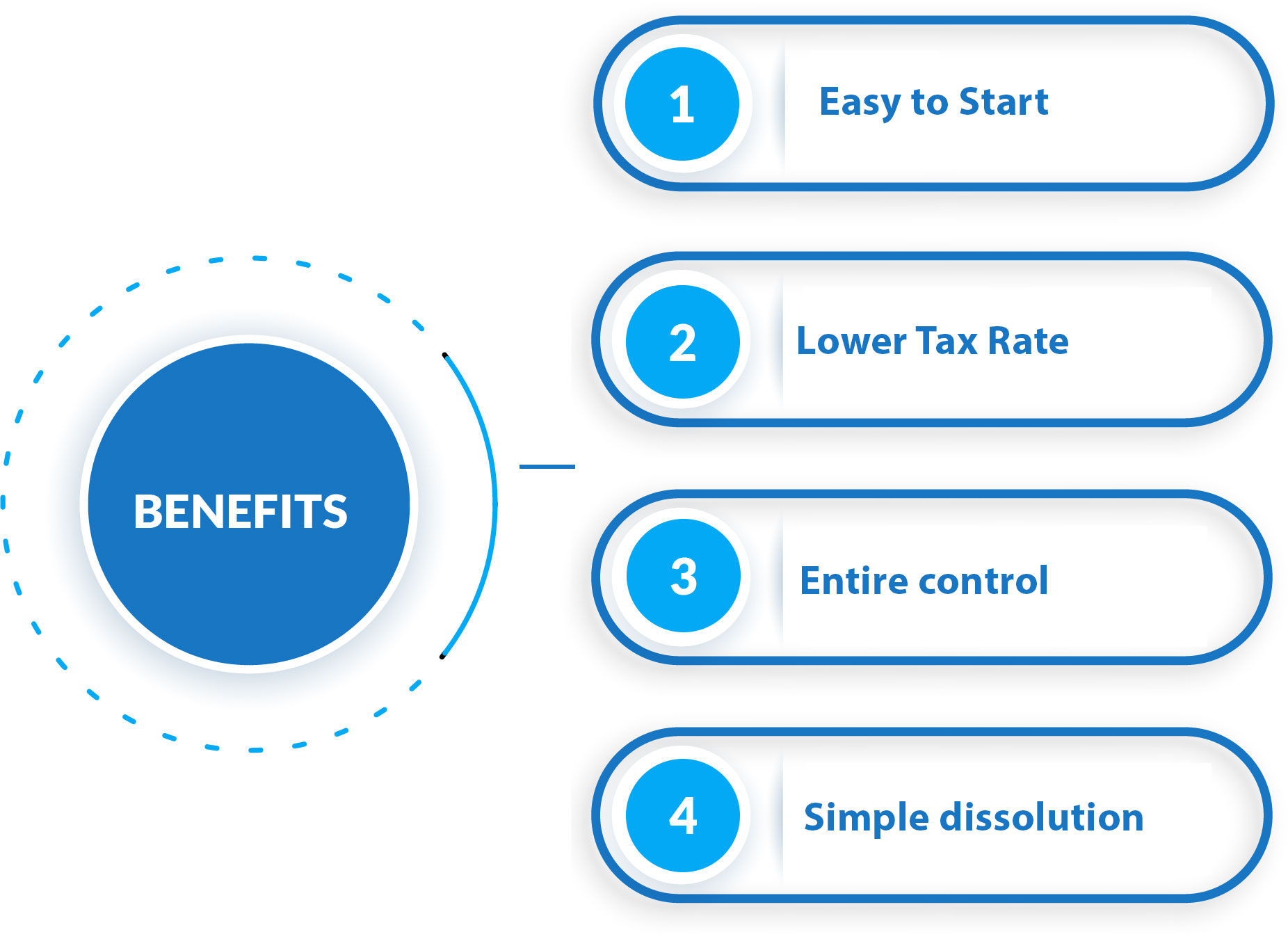

Proprietorships are simple to establish and have the least stringent regulatory compliance requirements. In India, the most common type of business is a sole proprietorship, which is utilised by the majority of micro and small enterprises in the unorganised sector. Some licences are required to operate a business as a sole proprietor. The type of licence required will be determined by the industry, state, and location.

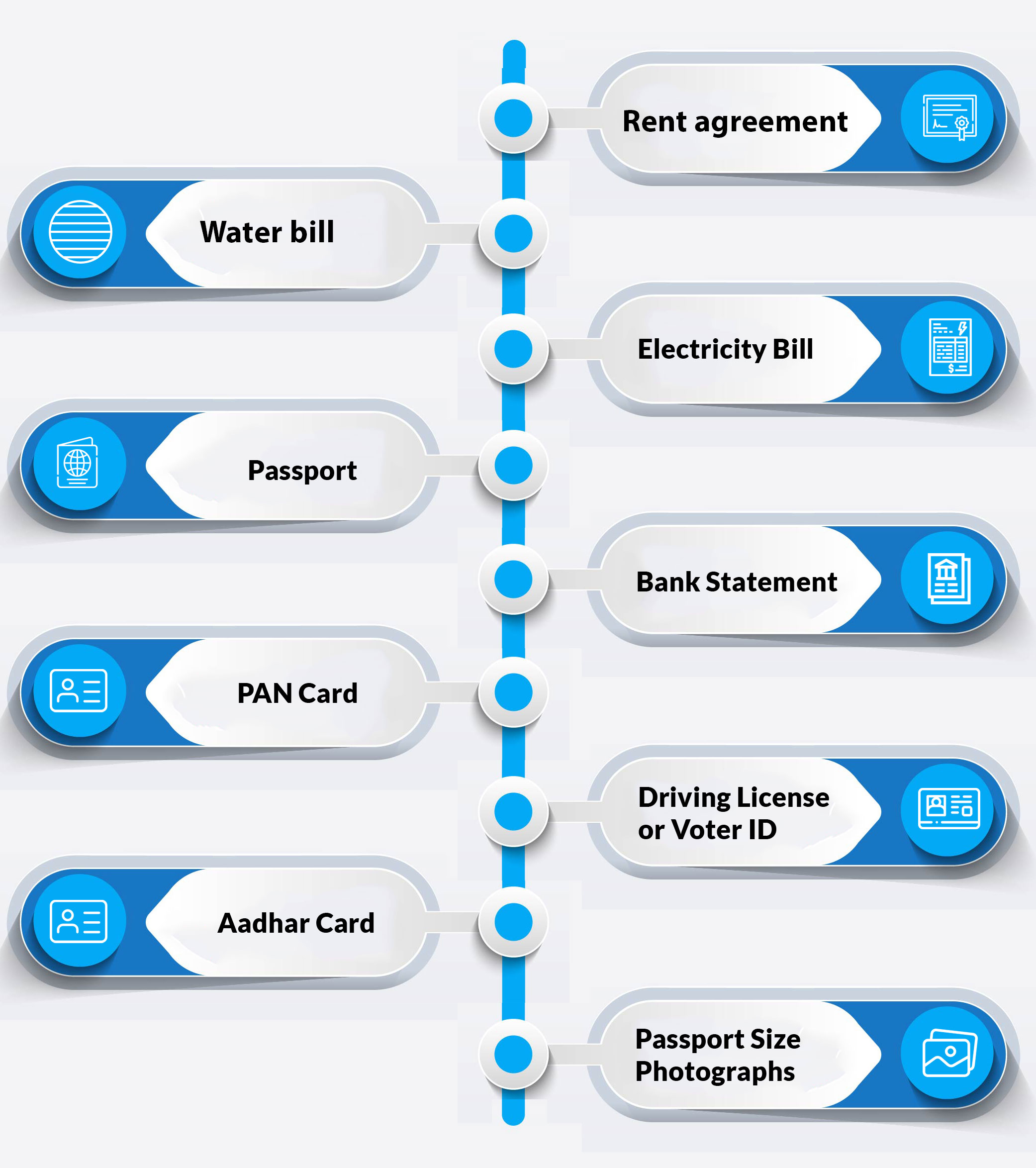

The following requirements must be satisfied in order to register as Proprietorship Firm: GST Registration MSME Registration Shop and Establishment Act LicenseTypes Of Registrations Required

Below is the process of registering your business as Proprietorship Firm -

Application for GST registration must be lodged with the department based on the needs of the business and the GST Law. GST registration takes about 5-10 working days on average.

You must file an application for registration as a Small and Medium Enterprise (SME) under the MSME Act to establish the existence of your proprietorship firm and to receive different benefits. It is advantageous to the company when taking out a loan. The government offers low-interest loans to SMEs through a variety of schemes.

According to the municipal legislation, you must obtain a shop and establishment licence. The municipal corporation issues it based on the number of employees or workers in the company.

The proprietorship firm should create a current bank account once all of the stages have been completed.

.png)

Legal Birbal is a reputed law firm with a diverse mix of young professionals working for it. The company was formed with the goal of transforming clients' business problems into unique and innovative solutions. We believe in putting our clients' needs first, understanding their business environment's intricacies, and providing solutions to satisfy those needs.

A sole proprietorship can be started by any Indian citizen who has a current account in the name of his or her firm.

Setting up and operating a Sole Proprietorship business takes no more than 15 days.

Yes, in order to establish the existence of a proprietorship firm, one must obtain GST registration.

From grocery stores to fast-food restaurants, as well as small traders and manufacturers, the majority of local businesses are conducted as single proprietorships.