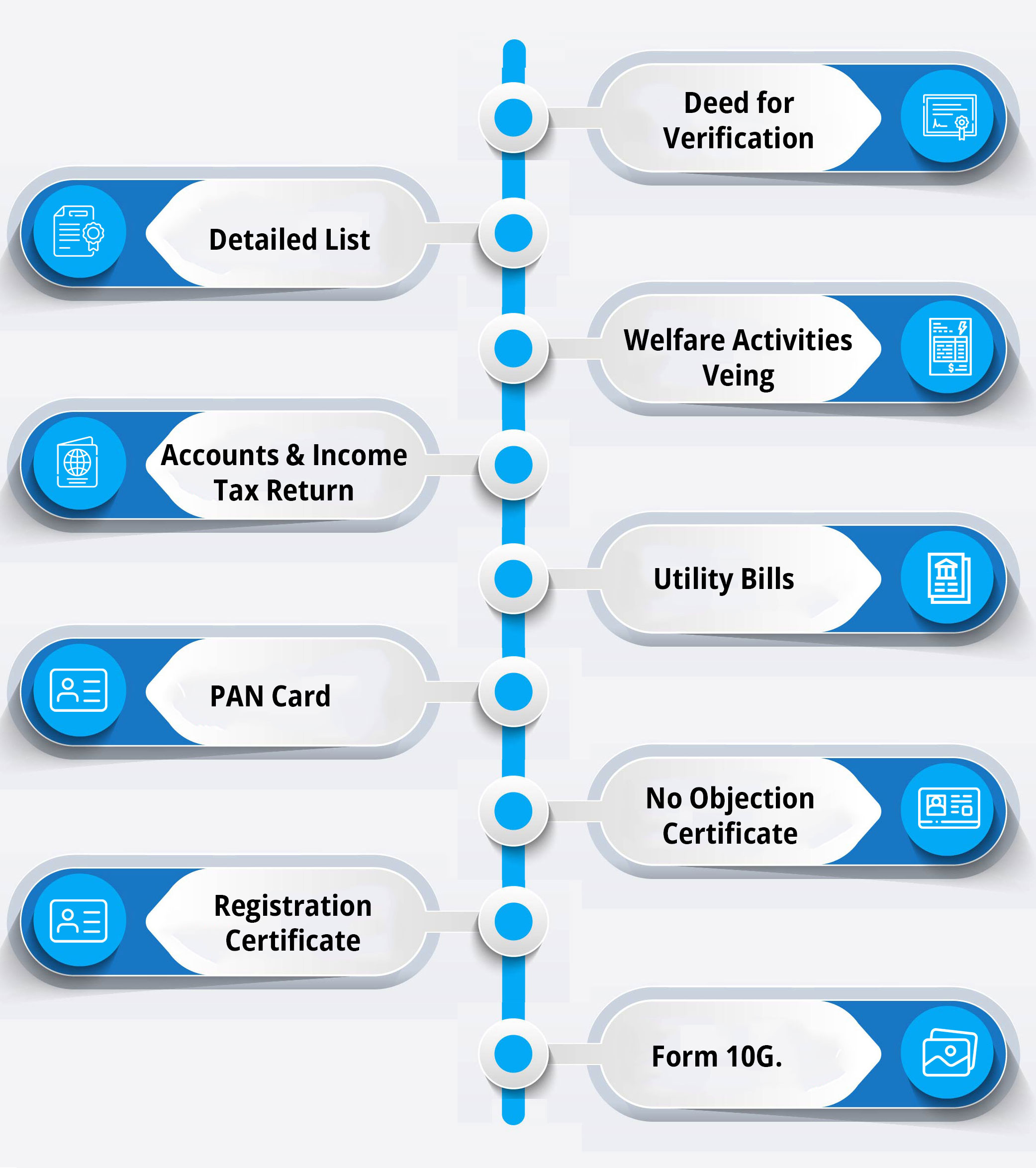

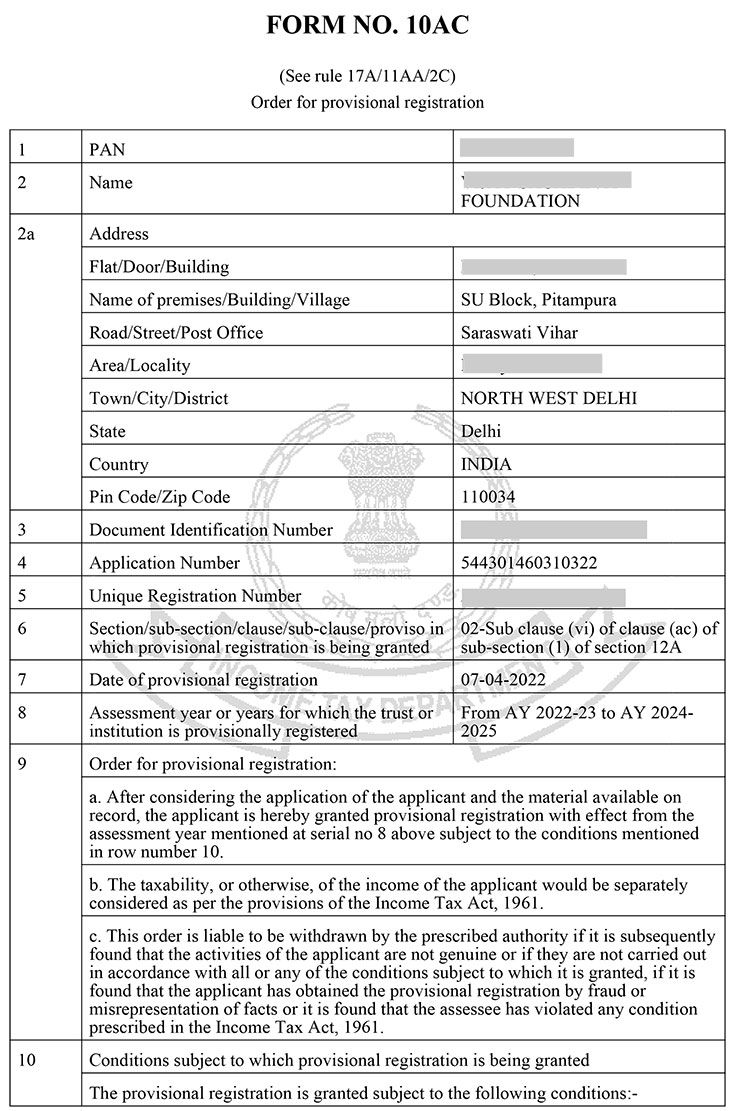

NGOs are formed for charitable purposes, and the government grants tax breaks to help them raise funding. Section 80G of the Income Tax Act provides benefits to an NGO's donors, whilst Section 12A Registration would help an NGO get its income tax-free. Both the 80G and 12A registrations are only for non-profits and charity organisations. Furthermore, due to recent revisions, all NGOs that were previously registered under these two sections must now re-register under sections 80G and 12A in order to continue receiving tax benefits. In addition, if an NGO wants to get CSR funds, they must fill out Form CSR-1.

Legal Birbal has worked with a variety of non-profit organisations and is familiar with their needs. Our team of experts has extensive expertise and is well-versed in legal technicalities.

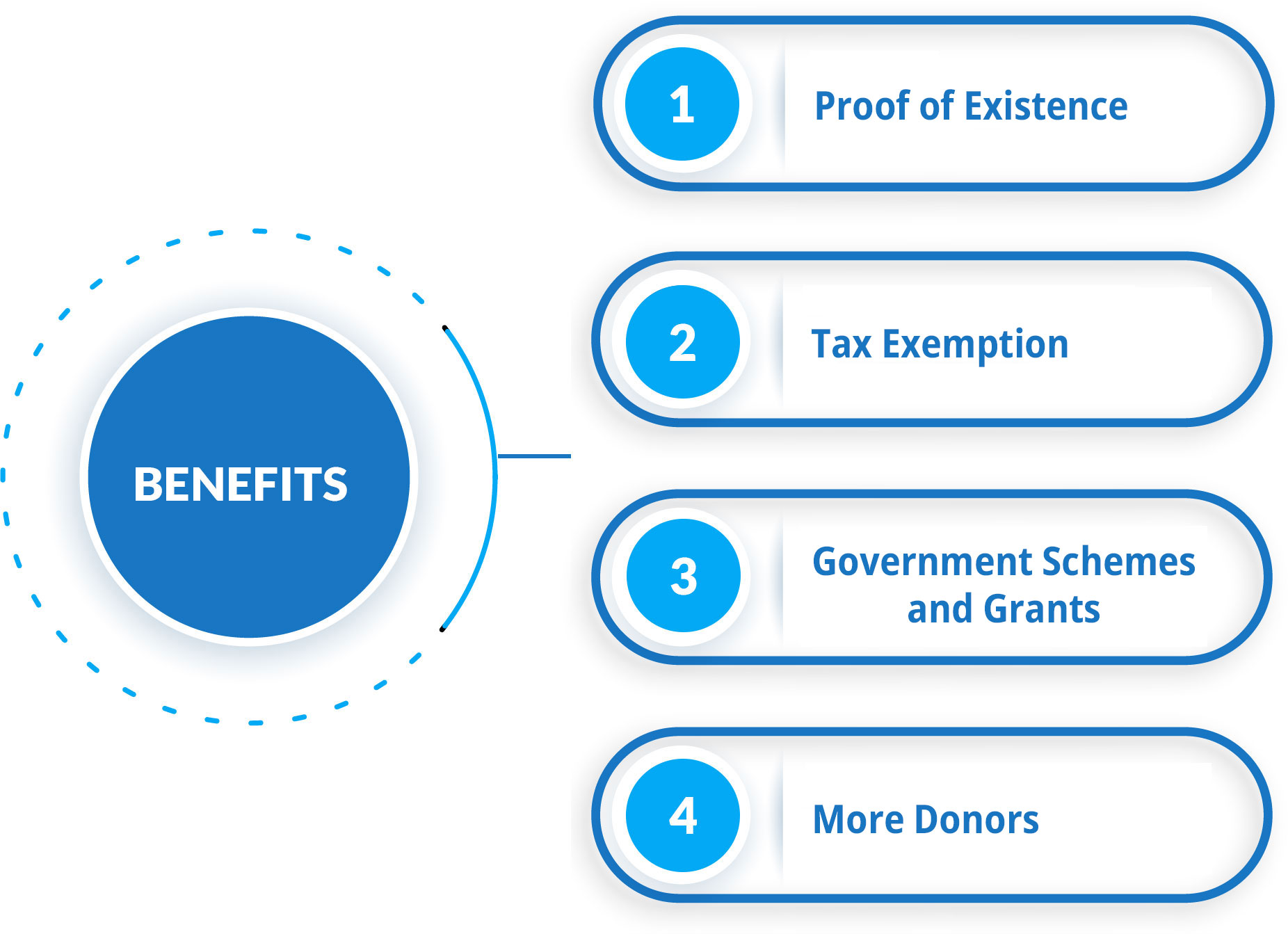

Registration trusts and non-profit organisations are free from paying taxes under Section 12A. An NGO's donor can profit from 80G registration.

Professionals like Legal Birbal gives online legal services that can help you apply for 12A and 80G.

80G registration is open to all government-approved organisations and trusts. To find out, go to www.incometaxindia.gov.in and search for your company or trust.

New 12A and 80G registrations can be filed as soon as the company is formed.