The Limited Liability Partnership Act of 2008, which established the concept of LLP in India, was passed in 2008. The purpose of the Limited Liability Partnership (LLP) was to create a simple corporate structure that would benefit owners by limiting their liability. Professionals, Micro and Small Businesses that are family-owned or closely held prefer LLP. It allows owners to restrict their responsibilities while taking advantage of the benefits of a limited company, giving them an advantage over a traditional partnership firm.

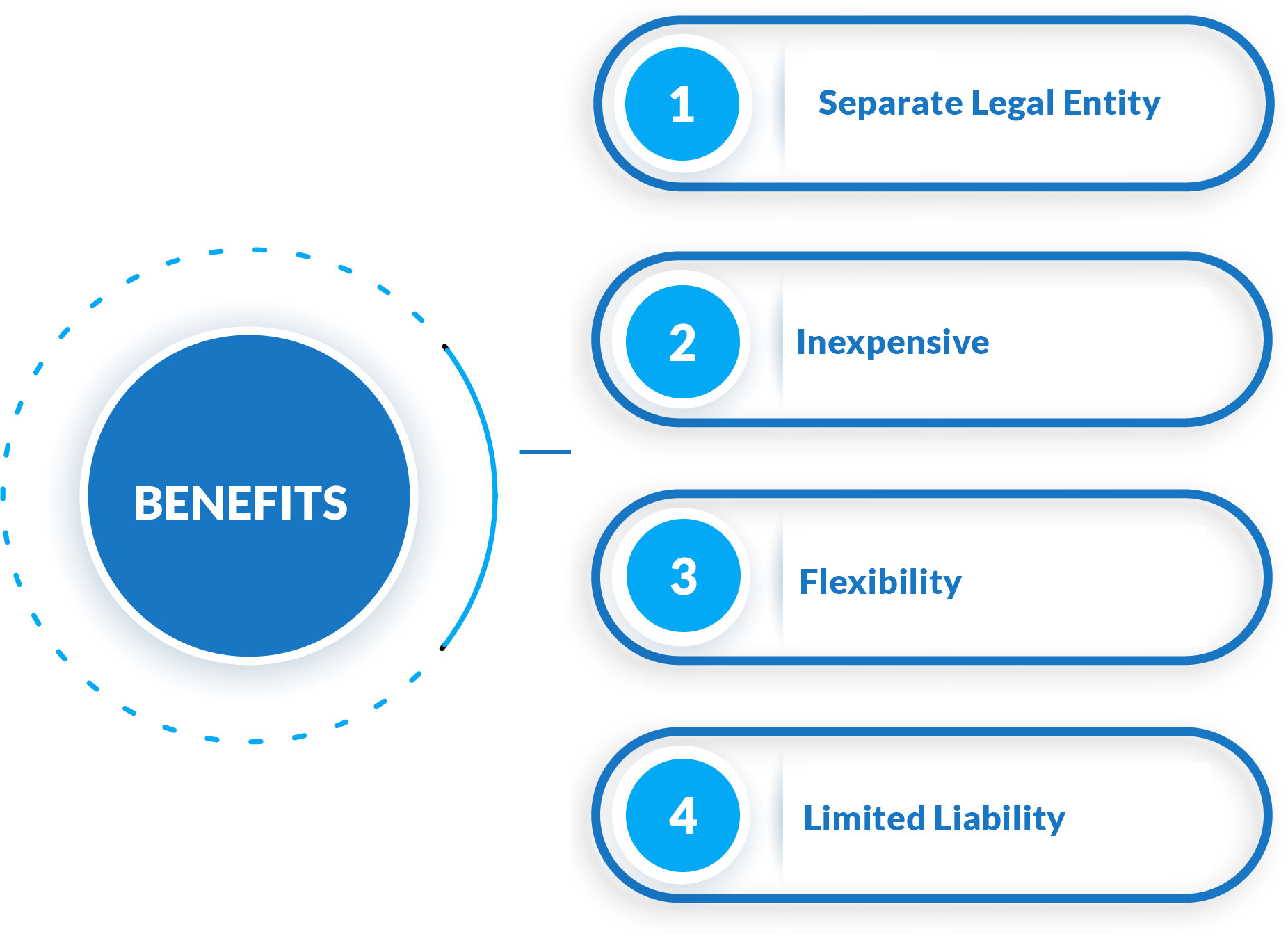

LLP Registration in India has grown in popularity as an alternative business structure that combines the benefits of a company and the flexibility of a partnership firm into a single entity. A minimum of two partners is necessary to form an LLP, but there is no upper limit. LLP also offers the owners "limited liability protection" against the LLP's debts.

The following requirements must be satisfied in order to register as an LLP: Minimum 2 partners & 2 designated partners are required No minimum share capital required DIN (Director Identification Number) for all the Designated Partners DSC (Digital Signature Certificate) for all the partners / Designated Partners Address proof for office of LLPMinimum Requirements

0

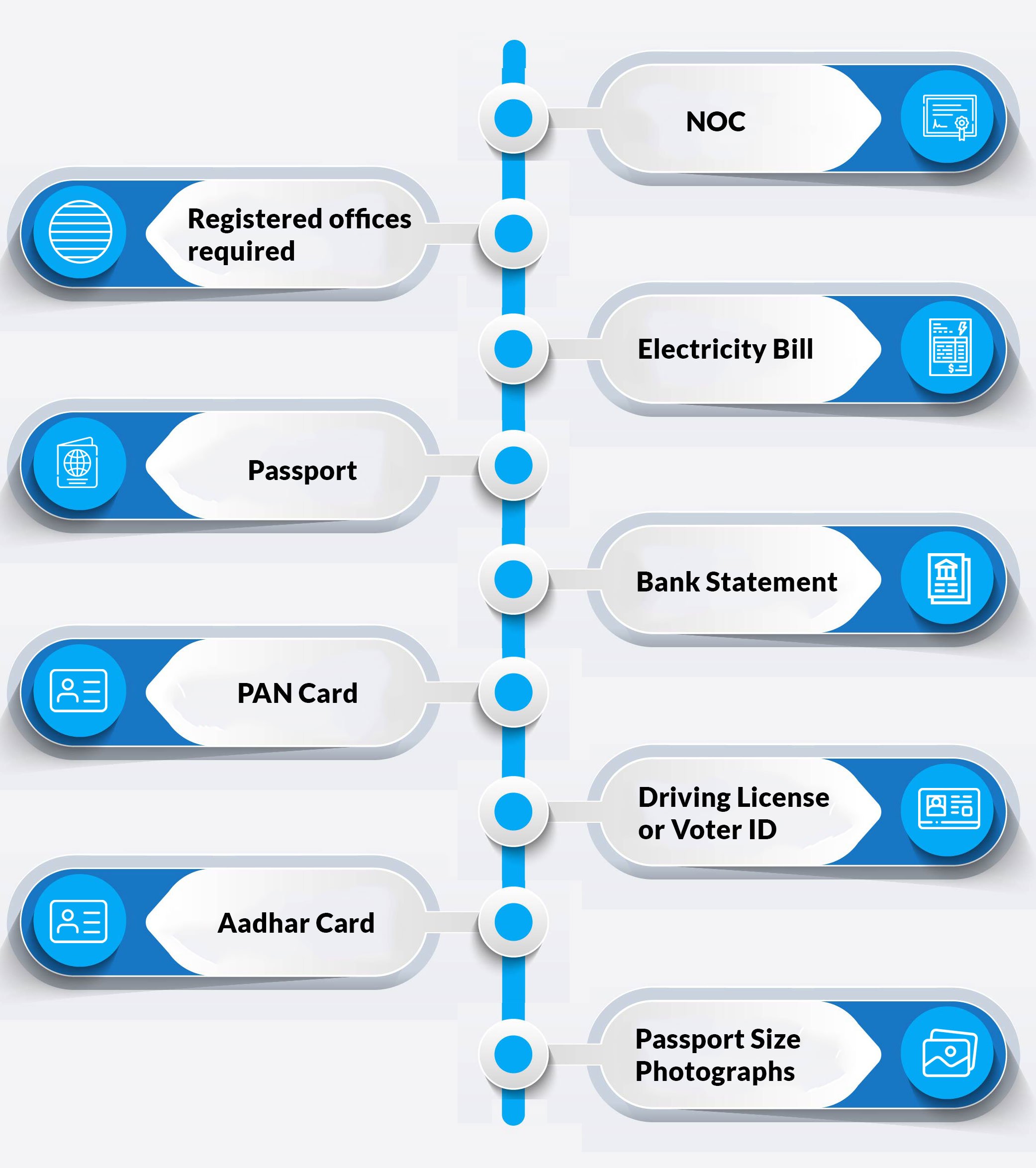

Copy of each following document required -

Below is the process of registering your business as LLP-

The directors' DSC is required for all forms that must be submitted online. Obtaining DSCs and DINs for two partners is the initial stage in the procedure.

At the same time, we check to see if the name you wish to use is available and reserve it for your LLP. The registrar will only approve the name if the concerned authority does not find it objectionable. There should be no resemblance to any existing partnership firms, LLPs, trademarks, or companieswith the same name.

The next stage is to draft the LLP agreement as well as other registration paperwork. In a limited liability partnership, an LLP agreement is particularly important since it establishes the mutual rights and responsibilities of the partners and between LLP. When the LLP is registered online using the MCA portal, the partners enter into an LLP agreement. This step must be completed within 30 days of the incorporation date.

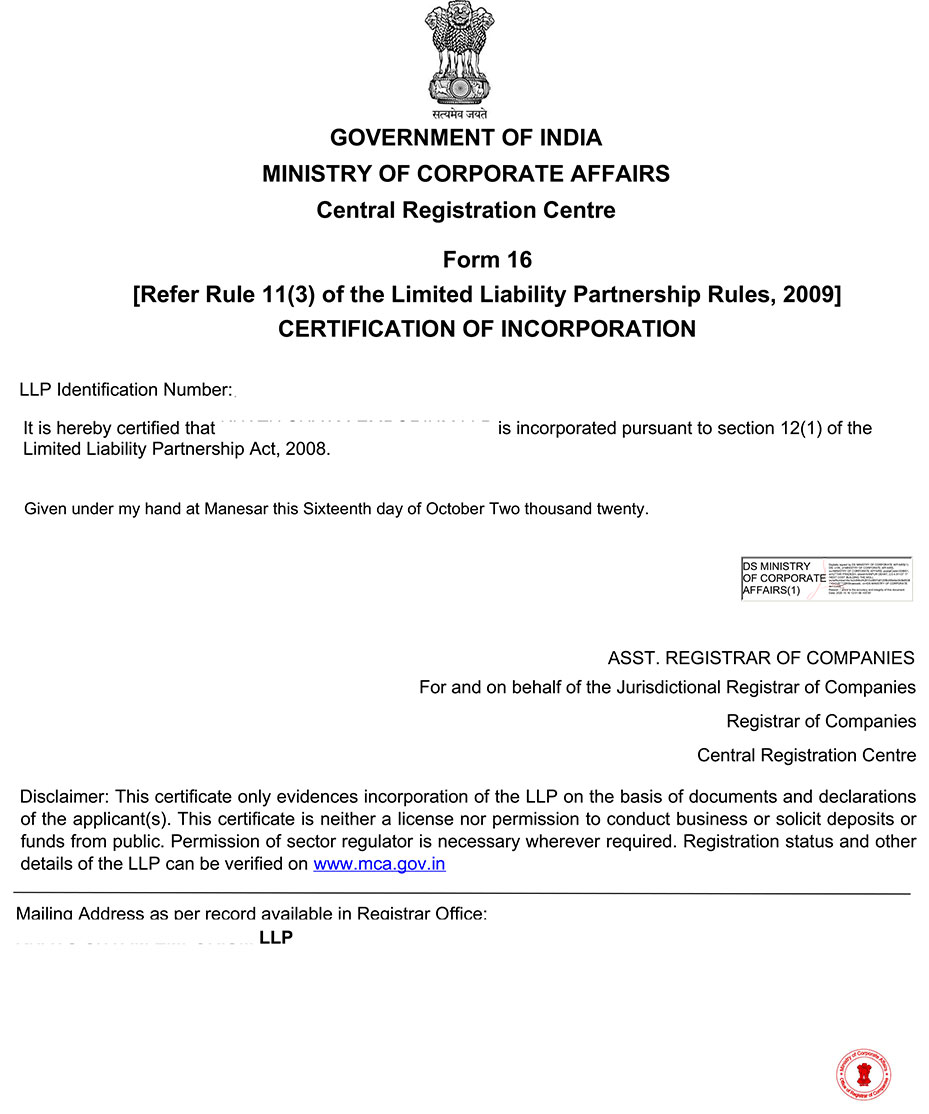

You'll get your LLP incorporation certificate once the registrar confirms all of the papers and documentation, and you'll be almost ready to start running your business.

We will apply for GST, Bank Account, &any other registrationsas soon as you receive the incorporation certificate.

Certificate

A simple and easy-to-use website allows you to complete all of the steps required to register your LLP. It's entirely online and may be viewed via a desktop computer or mobile. Our experts are knowledgeable about the rules and have assisted firms just like yours in forming LLPs.

It is a more advanced kind of Partnership that combines the limited liability of a Private Limited Company with the flexibility of a Partnership firm.

The "Limited Liability Partnership" registration procedure takes 15 to 30 working days (approximately).

A partner might be an individual, a company, or an LLP.

In order to register an LLP in India, all partners must present sufficient identification and address proof, as well as the address proof of the registered LLP office.

Yes, an LLP is far less expensive to run than a private limited company, especially in the early stages of your business.