GST modification or update refers to any modifications made to the GST registration or the details contained in the GST certificate. If you want to switch from the composite to the conventional scheme, or if your GST registration is incorrect, you can modify it. To get a GST adjustment, fill out the GST REG 14 form.

Notices under GST are communications by the GST Authorities. These are sent to the taxpayers specifically to remind or caution them of any defaults being noticed, specifically for not following the GST laws. The GST Authorities communicate with the public through notices. These are delivered to taxpayers to remind or warn them about any defaults that have been detected, specifically for not adhering to GST requirements. Any response to a GST notification can be sent using the GST portal. A taxpayer can utilise the digital signature or e-signature of the taxpayer's authorised personnel or his own. Where payment of tax and interest is due, do so in the appropriate form and manner.

Below is the procedure for TDS return filing-

Legal Birbal is a prominent accounting service provider that can offer you with everything you need if you have an internet connection on your phone/computer and the required documents with you. We can get the work done no matter where you are in India.

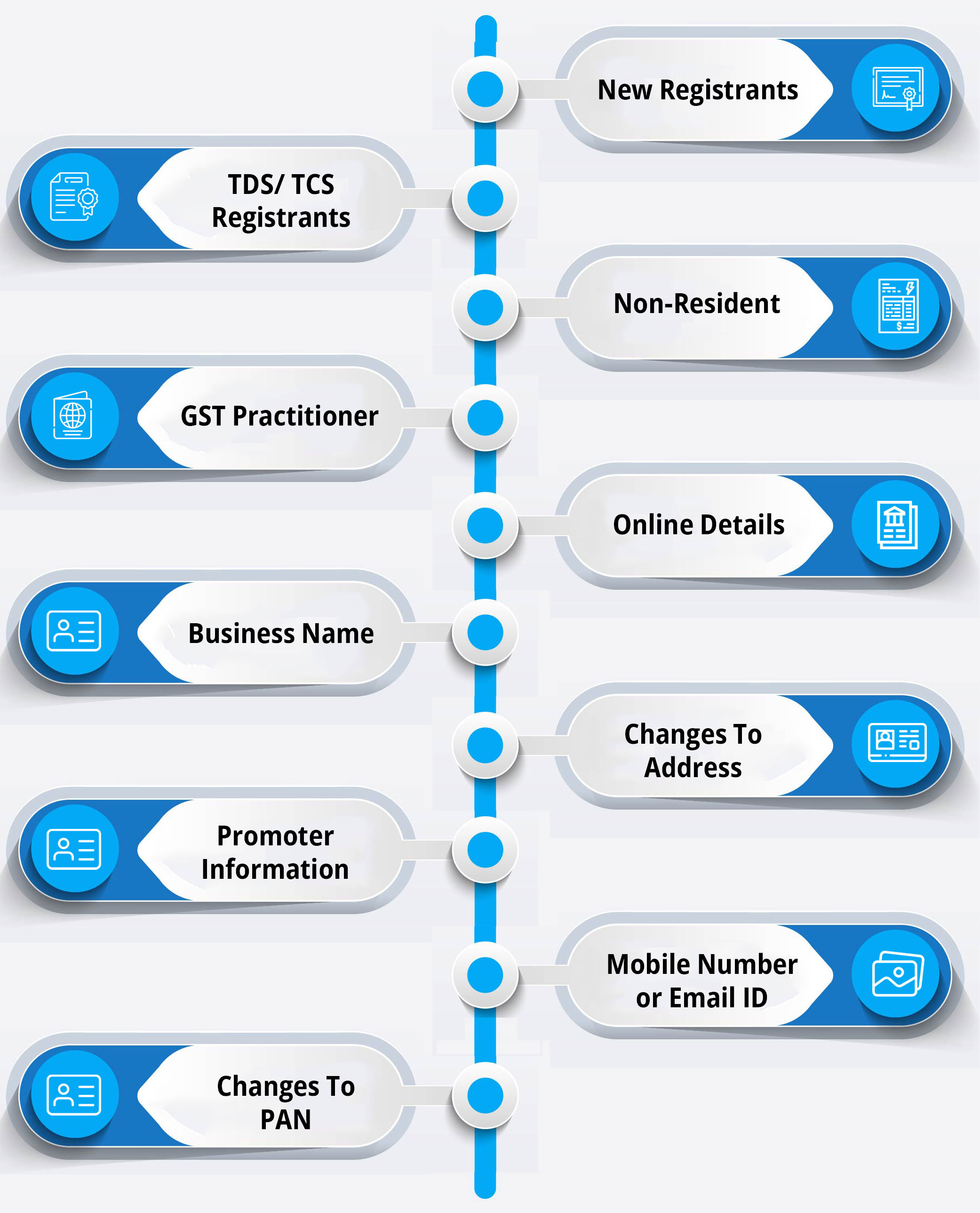

Following are the core fields in GST registration-

All those details are referred to as the Non-core fields under GST Registration that are related to GST application except for-

Yes, if you can add an additional business address to your existing GST certificate.

GST Notices come in a variety of forms, including show cause notices, demand notices, and scrutiny notices, to name a few.

Any response to a GST notification can be sent using the GST portal. A taxpayer can utilise the digital signature or e-signature of the taxpayer's authorised personnel or his own.