A private limited company (PLC) is a privately held corporation for small businesses, startups and growing companies. A member's liability in a Private Limited Company is limited to the number of shares that he or she owns. Shares in PLC, however can be offered to existing shareholders, or to professional investors and companies. It is the most common type of business registration since it establishes a company's reputation and credibility in the marketplace. PLC must have a minimum of 2 shareholders and canhave maximum of 200. Shareholders are regarded the company's owners, while directors are considered the company's key managerial personnel (KMPs).

Incorporating a Private Limited Company is the best option since it can be formed easilyprovides business expansion, legitimacy, tax benefits, and faster loan approval. It encourages the easy development of capital and the pooling of funds among members.

According to the Companies Act of 2013, there are certain minimal standards that must be met before a business can be formed online. Registered office address 2 Directors &2 Shareholders Each director must have a Directors Identification Number (DIN) Members must be between 2-200Minimum Requirements

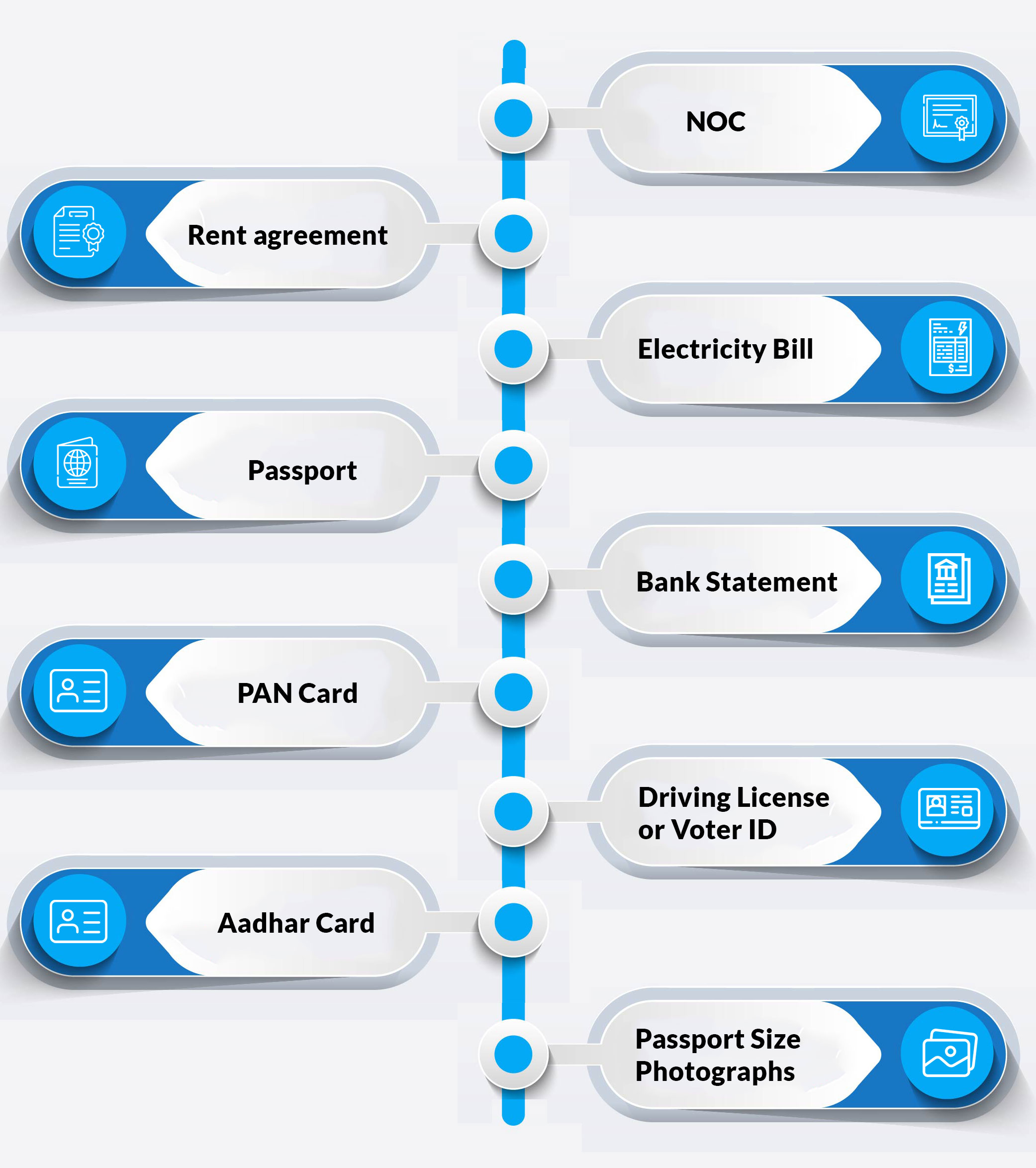

You must give sufficient identity and address verification in order to register your private limited company in India. These documents must be uploaded to the Ministry of Corporate Affairs (MCA) site by the company's directors and shareholders.

Copy of each following document required -

The process of registering your business is lengthy and involves numerous regulations.

Because forming a private limited company is a completely digital procedure, having a Digital Signature Certificate is a must. Directors and subscribers to the company's memorandum of incorporation must apply for a DSC from one of the certified agencies. Obtaining a DSC is a simple online process that may be completed in as little as 24 hours. Document verification, video verification, and phone verification are the three simple verifications involved in this process.

The SPICe RUN form, which is part of the SPICe+ form, can be used to apply for a name for a private limited business. The company's industrial activity code, as well as the company's object clause, must be defined when creating the name application.

After the name has been approved, the company's registration details must be written in the SPICe+ form. It is a simple proforma for electronically forming a company. The following are the form's details:

SPICe e-AoA and e-MoA are two related forms that must be completed at the time of company registration.

Section 2(56) of the Companies Act 2013 defines a Memorandum of Association (MOA). It's the basis upon which the business is based. It establishes the company's constitution, powers, and objectives.

Section 2(5) of the Companies Act defines the Articles of Association (AOA). It lays out all of the company's management rules and regulations in detail.

PAN, TAN, and Certificate of Incorporation shall be issued by the competent department after the Ministry of Corporate Affairs approves the above-mentioned documents.

Using these documents, the organisation is now required to open a current bank account. You can get help with your current bank account opening by contacting us.

The private limited company registration process is completely online, so you don't even have to leave your home to get your entity registered. With Legal Birbal and team, we complete the registration process within the a promised deadline -

In India, forming a private limited company is the simplest and most reliable method of doing so.

It will take no more than 15 days if you have all of your documentation in order. This, however, is contingent on the registrar's workload.

Both the LLP and the Pvt Ltd Company have advantages and disadvantages. It is entirely dependent on the business's requirements.

A Director Identification Number (DIN) is a one-of-a-kind identification number required to become a corporate director.

We are here to make your process easy and smooth. You can contact us to know more.