Section 8 Company or a Non-Profit organisation (NPO) is an organization registered with the goal of promoting the fine arts, science, literature, or knowledge sharing for a charitable cause. The word "no profit" does not imply that the company cannot make a profit or earn money; rather, it signifies that the money is used to promote the object rather than being distributed to the promoters. It means that the corporation can make money, but the promoters are not entitled to any of it.

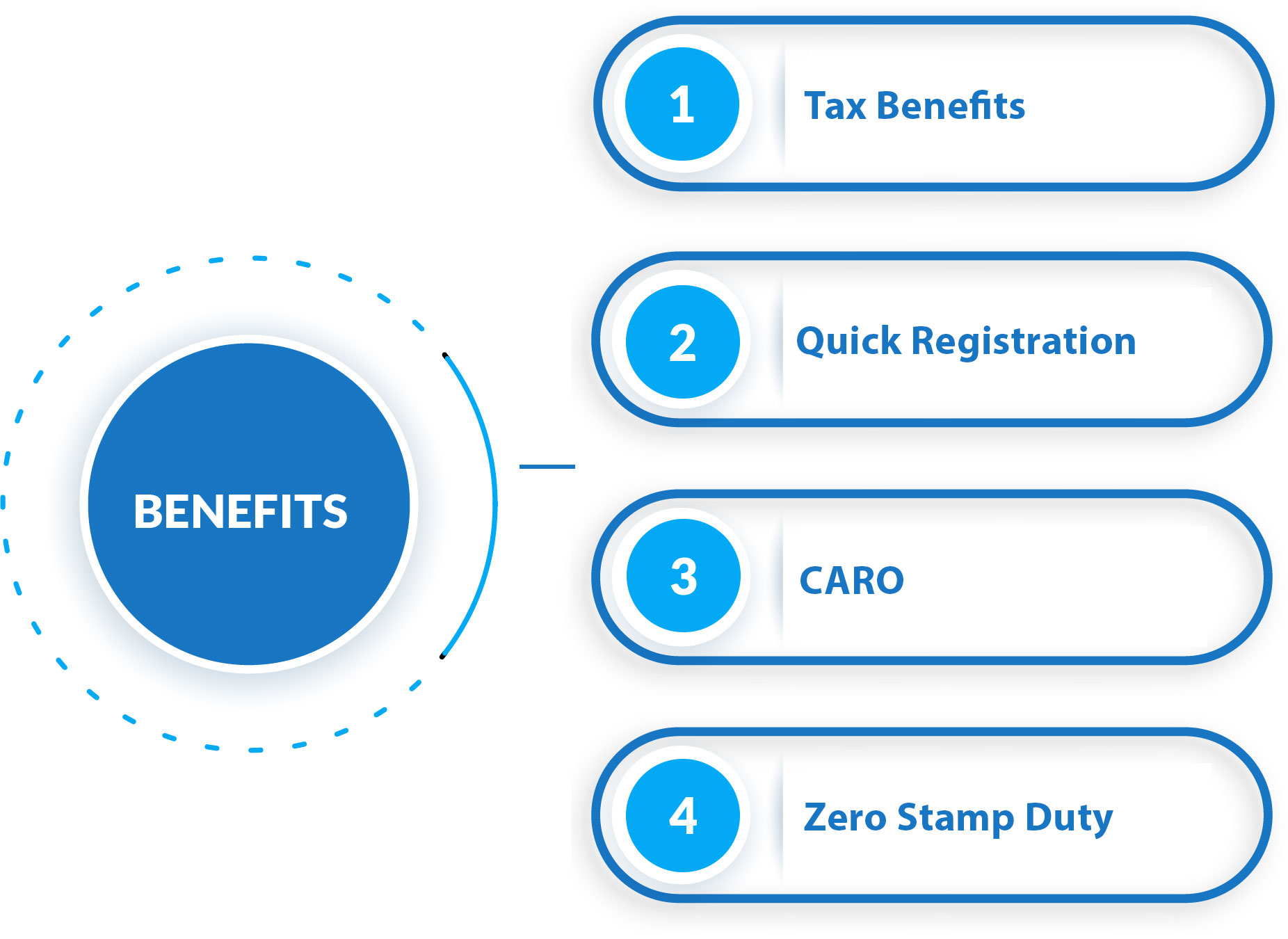

It is the most common type of NGO registration, and it carries more weight with donors, government officials, and other stakeholders. Profits and donations are used solely to promote the company's objectives, with no dividends issued to its members or owners. Section 8 Company benefit from a number of exceptions and relaxations as compared to other types of companies. A private limited business or a public limited company can be formed under Section 8 Company.

The following requirements must be satisfied in order to register as Section 8 Company: Registered office address Minimum 3 directors in case of incorporation as a public limited company with one director should be the resident of India Minimum 2 directors are required if Section 8 company is incorporated as a private limited company Formation should be for charitable or social purpose onlyMinimum Requirements

Below is the process of registering your business as Section 8 Company-

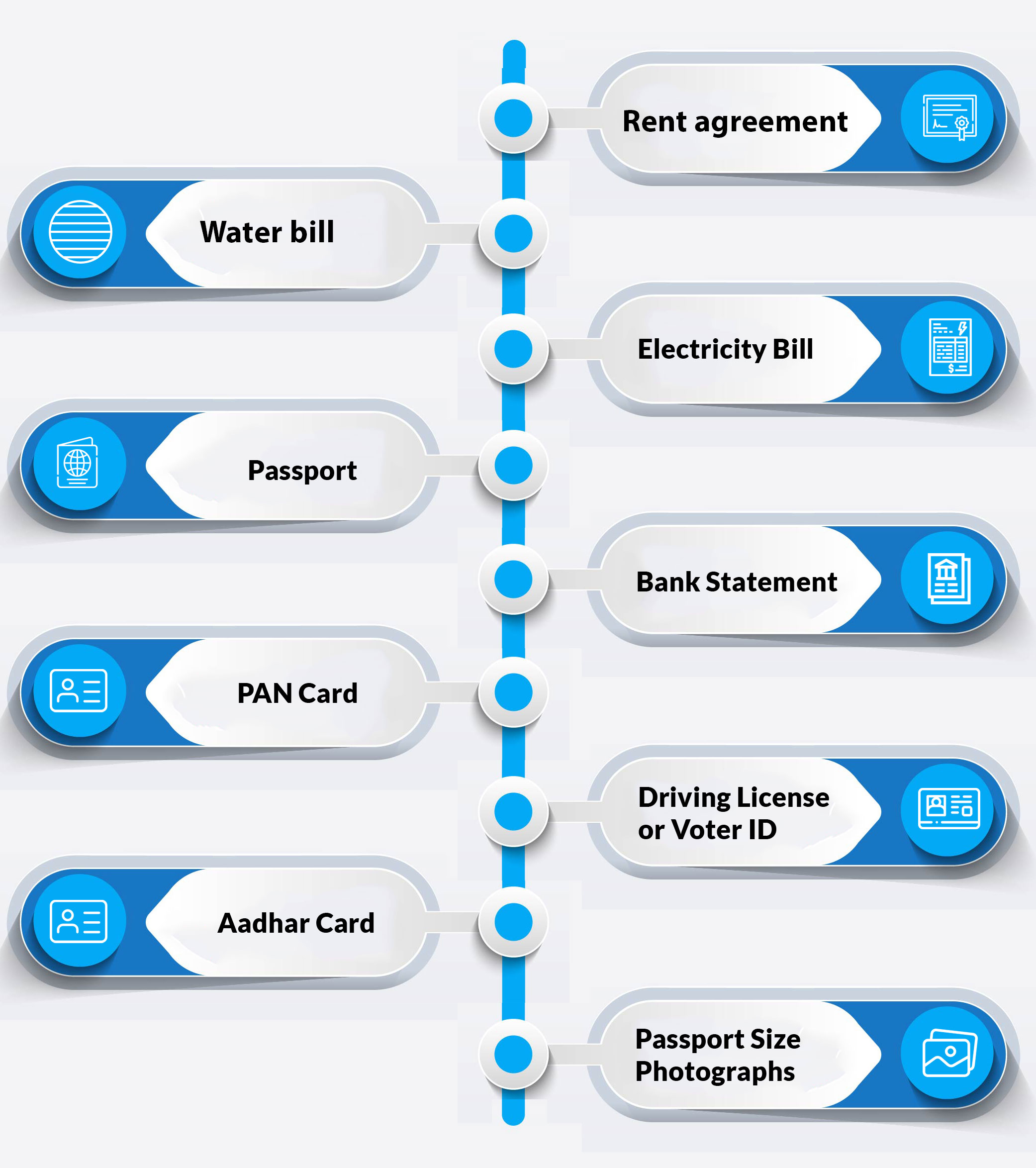

A Digital Signature Certificate is required since the formation of a Section 8 Company is completely digital. A DSC from one of the certified agencies is required for directors and subscribers to the company's memorandum of incorporation.

Use the SPICe RUN form, which is part of the SPICe+ form, to apply for a name for a Section 8 Company. The company's industrial activity code and object clause must both be defined while filling out the name application.

Form INC-12 must be filed with the Registrar of Companies in order to get a licence under Section 8 Company. Prior to the granting of a Certificate of Incorporation for a Section 8 business, the Ministry of Corporate Affairs issues an approval letter under Section 8 of Part 1, i.e., a License under Section(1) of the Companies Act, 2013. The ROC will provide a 6-digit Section 8 licence number once the paperwork has been authorised by the Central Government.

After the name has been approved, the company's registration information must be entered into the SPICe+ form. It is a simple proforma for electronically forming a corporation. The form's specifics are shown below.

The SPICe e-MoA and e-AoA are two forms that must be completed at the same time when a company is formed.

If the Ministry of Corporate Affairs approves the above-mentioned papers, the PAN, TAN, and Certificate of Incorporation will be issued. These documents must now be used to open the organization's current bank account.

.png)

Legal Birbal is a well-known law firm that employs a broad group of young professionals. The company was founded with the purpose of turning clients' business challenges into distinctive and inventive solutions. We believe in putting our clients' needs first, understanding the complexities of their business environment, and developing solutions to meet those needs.

The Indian Companies Act, 2013, defines a Section 8 corporation as a philanthropic or not-for-profit organisation.

Yes. It might be a private or public limited liability business. A Section 8 corporation is almost always registered as a private limited company.

There is no requirement for a certain amount of capital. It is up to the shareholders and directors' discretion.

The terms Private Limited (Pvt. Ltd.) or Limited (Ltd.) shall not appear at the end of the name of a Section 8 Company (NGO).